Find long term rentals with the best cash flow in seconds

CashOn runs deal analysis for you, gathers income + expense data, and finds you real estate investments with the

best cash on cash return.

Maximize your cash flow and invest confidently with data driven investments.

Start for freeWhat our Customers Say

CashOn has been a game changer for me. I run a mentorship program where I teach my students how to invest out of state. But now with CashOn, I can help them find deals in minutes.

Also I've been able to scale my business as an agent. Before I had to first find buyers then find them deals. Now I can find the deals first with CashOn and use them as marketing to find buyers. I use the deals as a way to get inbound leads and run a newsletter.

The best part is I worked with the team to add "Last Sold" data to the app. Being able to filter by properties last sold between 2019 - 2022 helps us find low interest rate seller financing deals.

Brian Canady

Cash Flow Couple | Mentor | Agent | Investor

During covid, home prices in my area skyrocketed and I could not find any deals.

I searched for 2 years, bouncing between bursts of motivation and getting demoralized when I couldn't find any deals.

In my first week using CashOn I learned that the 5 markets I had been monitoring had no cash flow and pivoted to a new market in a college town. By the second week, I put in 2 offers and by the third week, I had both under contract.

But the most helpul part of CashOn is it gave me a system to scale my portfolio. CashOn helps me find properties that have high enough cash on cash return to qualify for DSCR loans so my ability to buy property is no longer tied to my salary.

Adam

Closed 2 homes in 3 weeks with CashOn

We have been investing in PHX and Vegas but I wanted to introduce another market that cashflows even better.

I've been using CashOn to see the average cashlow in new markets and neighborhoods which has saved me months of research.

It's ideal for quickly finding a shortlist of properties in a new market to discuss with an agent.

Liam

40x 🏠 Long Distance SFH Investor

Get started now

Find deals in minutes not days

It takes 8+ hours to analyze 100 properties and you might find a deal if you're lucky. (column 3, row 7)

It took us less than 10 minutes with CashOn to find a turnkey deal with 8% cash on cash return.

Watch the video

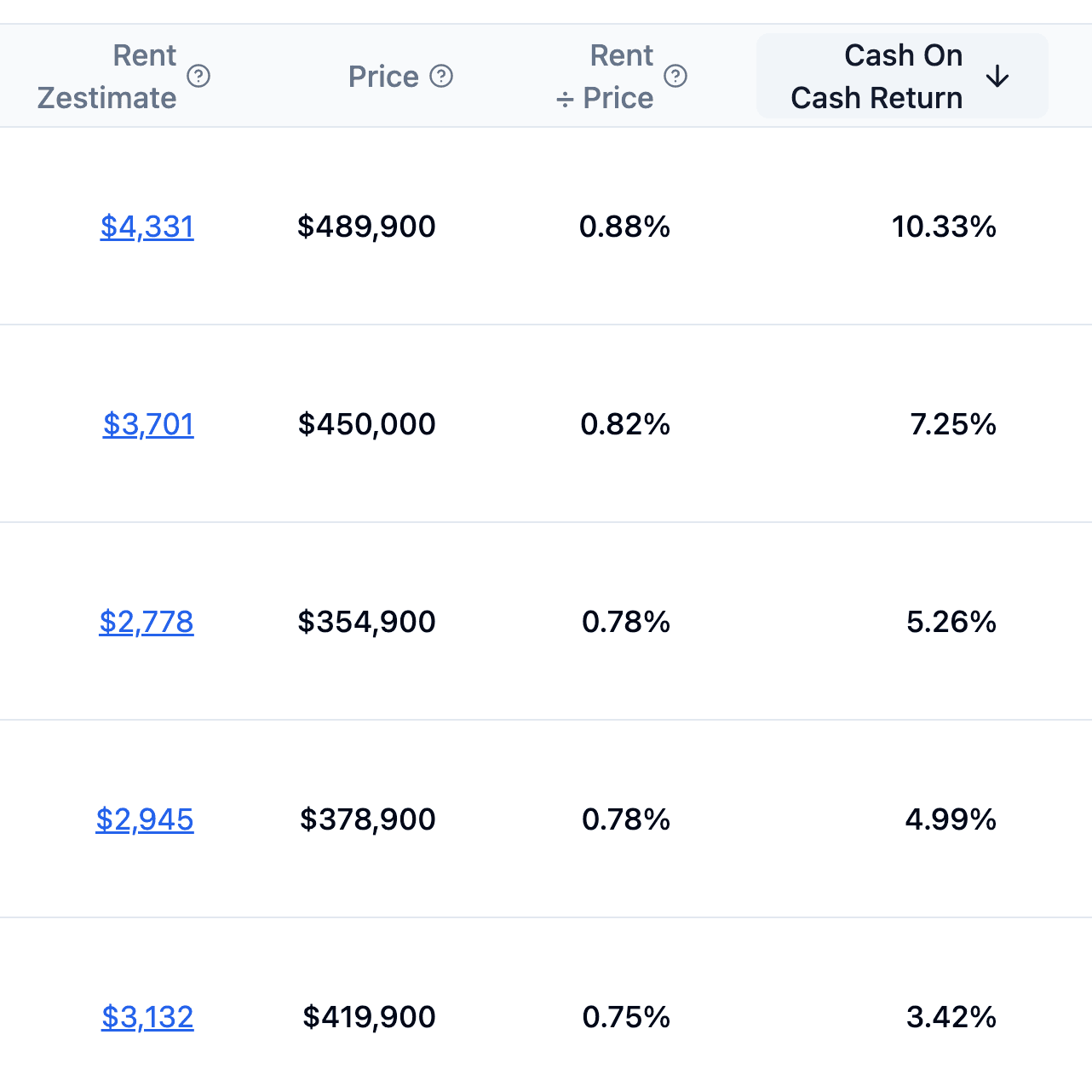

Find homes with the best cash on cash return

CashOn lets you view homes sorted by the highest cash on cash return so you can find homes with the best return on your investment.

Wave goodbye 👋

to spreadsheets with

one-click deal analysis

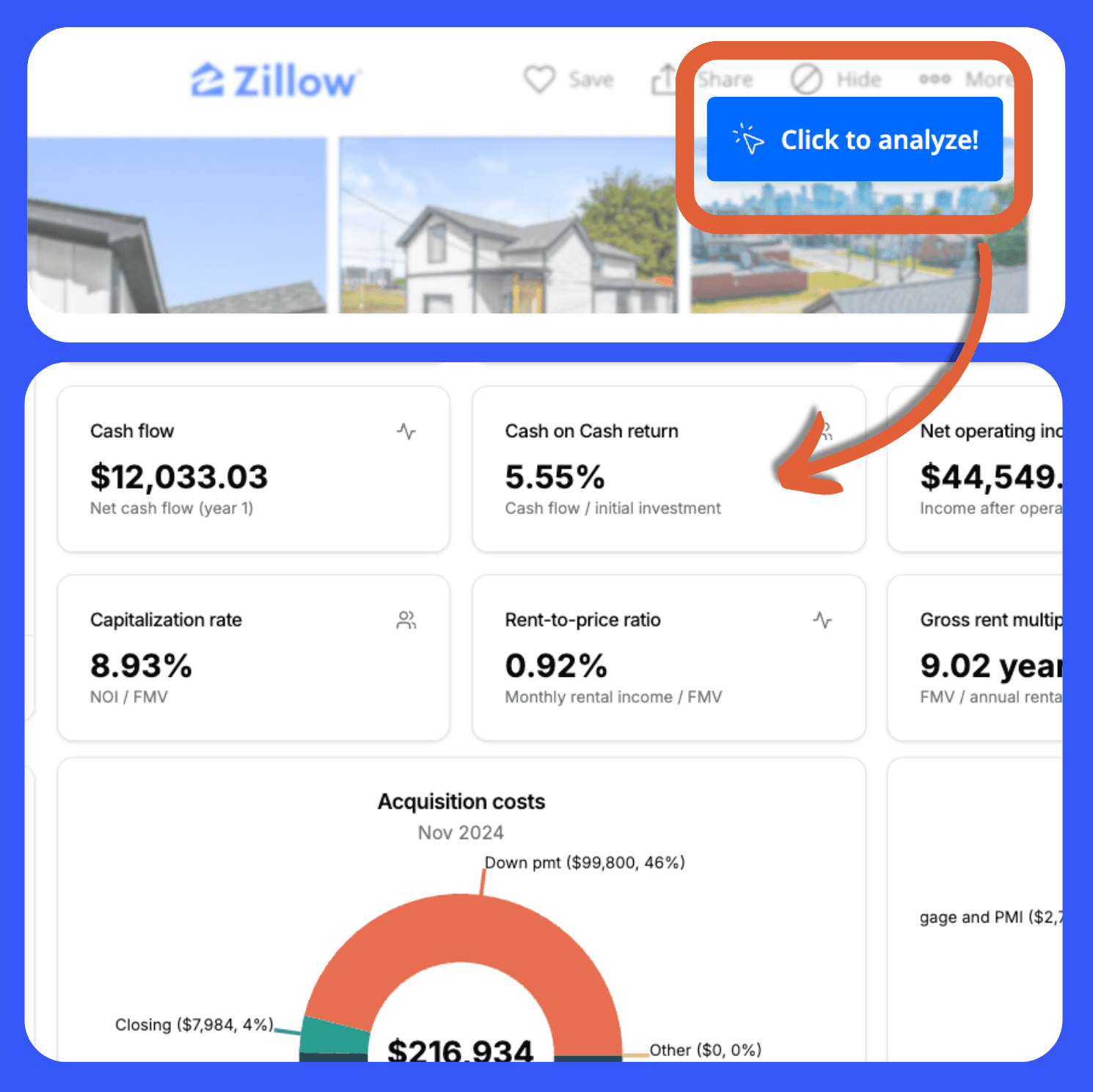

Tired of copying and pasting into spreadsheets?

With one-click, CashOn automatically pulls all the rent, mortgage, insurance, and expense data you need, into our Deal Calculator.

CashOn automatically calculates metrics like cash on cash return, cap rate, cash flow, and much more.

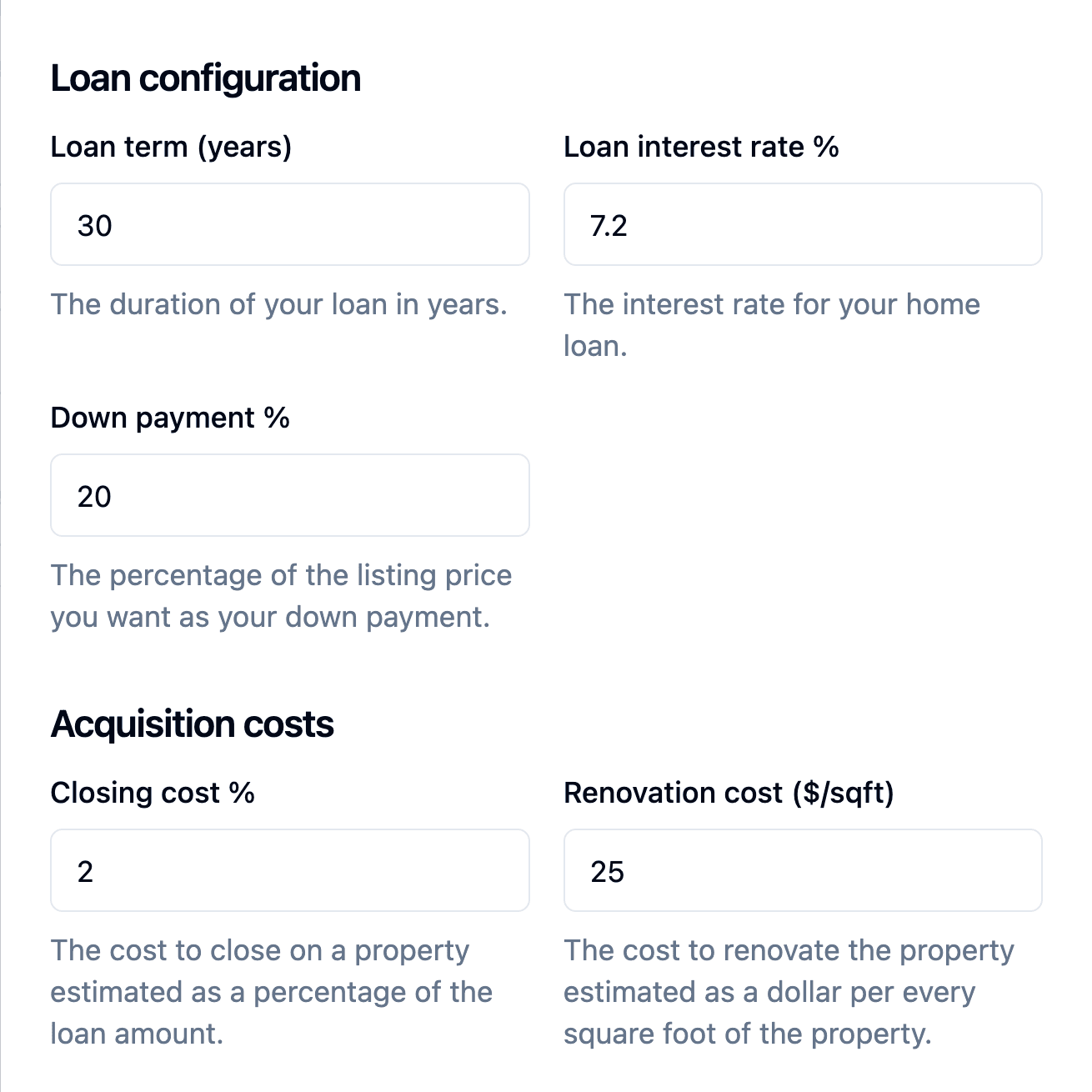

Deal analysis customized to you

Customize your deal analysis to your specific needs.

Override CashOn calculations to fit your custom buying criteria such as interest rates, renovation budget, management fee, vacancy, and more.

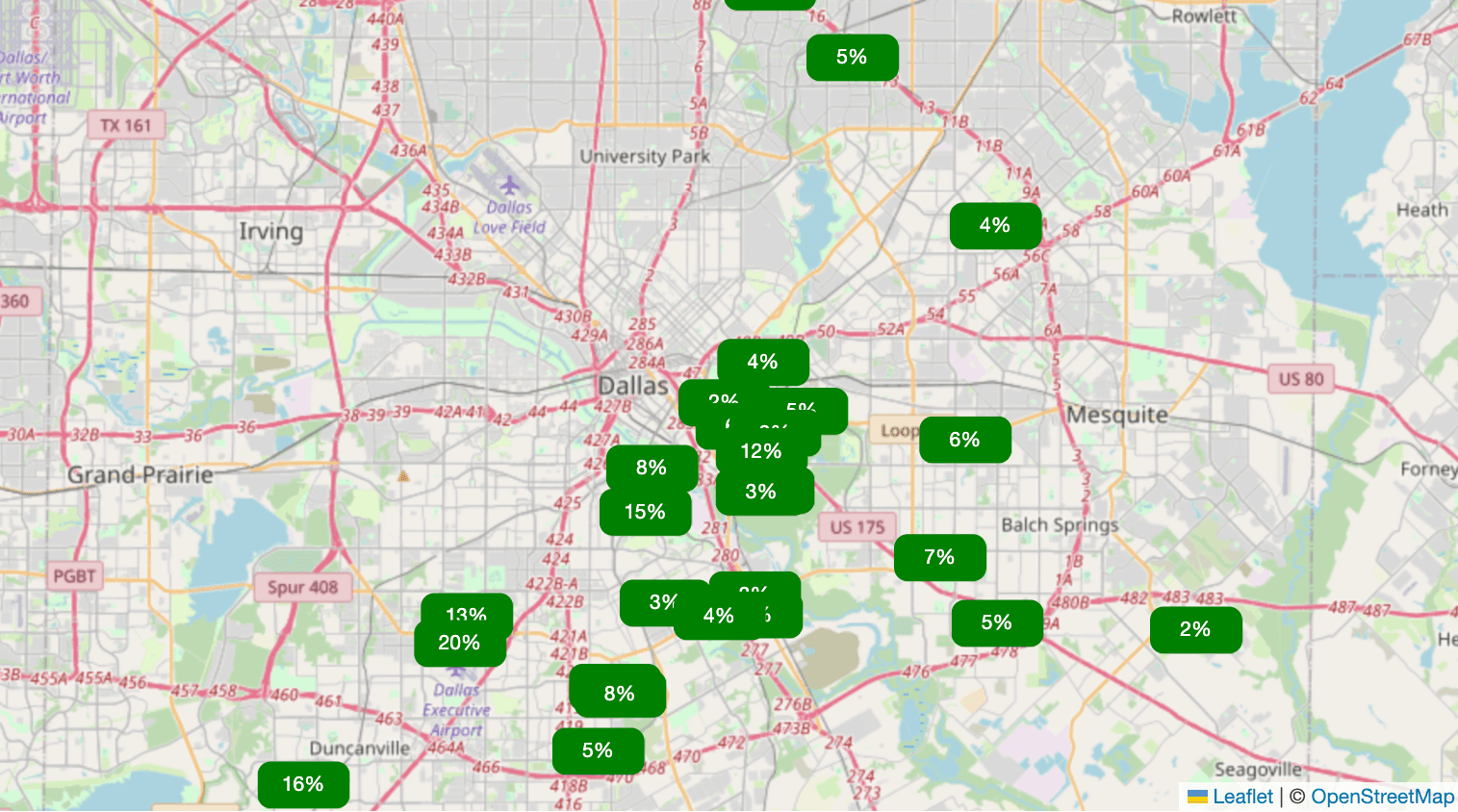

Find neighborhoods with the best cash on cash return

Not sure which city, neighborhood, or zipcode to invest in? Trying to expand your portfolio into new markets?

CashOn analyzes hundreds of properties to tell you which city and which neighborhoods have the best cash flow.

On the right, you can see South East Dallas, Texas has the best returns.

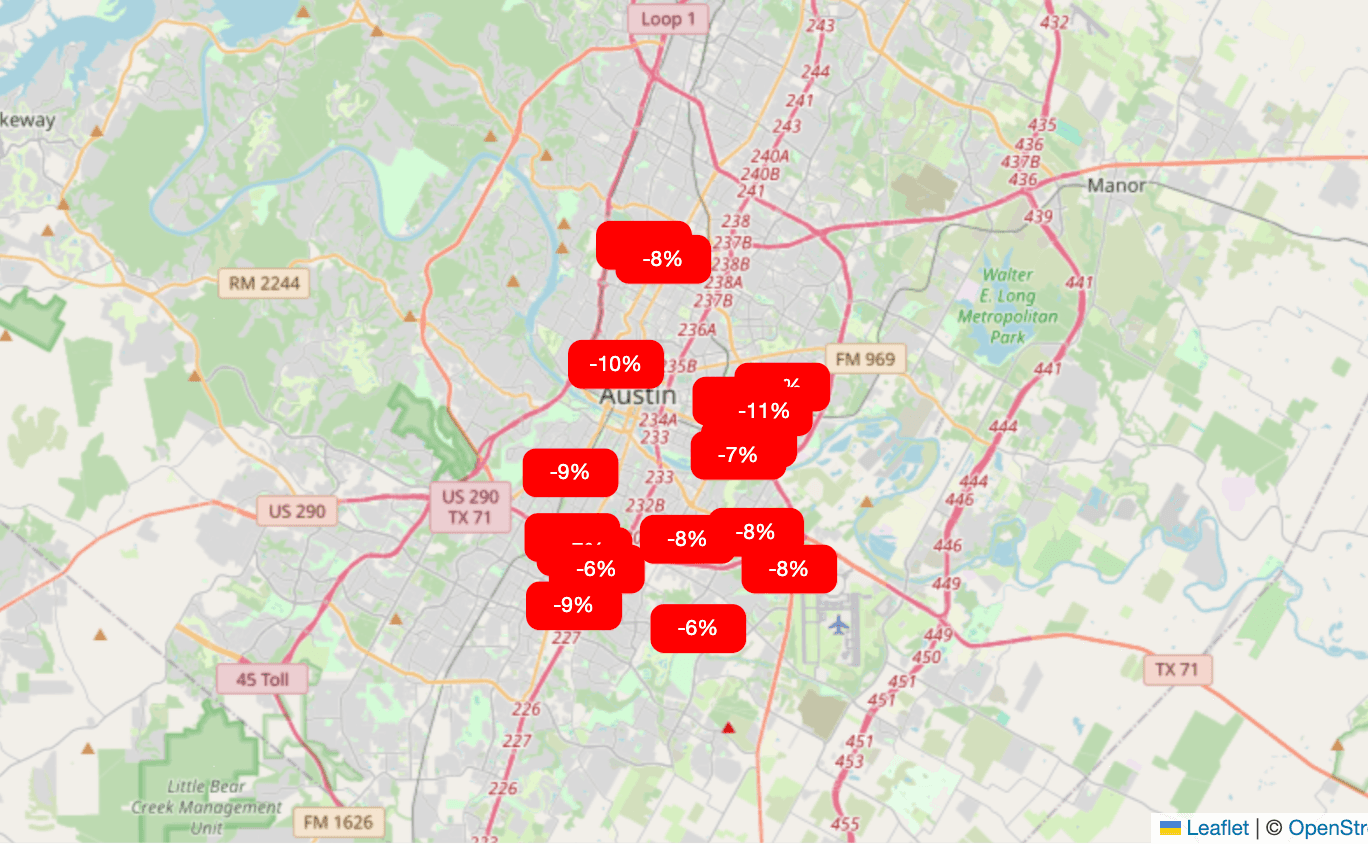

Stop wasting time in markets with negative cash on cash return

How many times have you burned 3+ hours and failed to find a deal? Are you wasting time in a market with no cash flowing deals?

CashOn quickly tells you if a market has little to no cash flow, allowing you to move on to other markets and save you time and sanity.

Get started now

How CashOn works

Have you ever wondered... "I wish there was an app that grabs all the data and analyzes homes for me"? That's exactly what we did! Stop spending hours copying and pasting numbers into spreadsheets and start investing!

If there is a metric, feature, or piece of data that is missing, click here to give us feedback!

CashOn gets home data

For each home, CashOn gets:

CashOn analyzes hundreds of homes

Using the information provided, CashOn analyzes hundreds of homes in seconds.

You can then sort by

Get started now

Our Pricing Plan

$ 0 / mo

Features

Analyze 1 home at a time

FREE deal calculator app

One click property analysis

Zillow integration

Product updates

Popular

Annual license$ 25 / mo

Features

Analyze up to 500 homes at a time

FREE deal calculator app

One click property analysis

Zillow integration

1 year unlimited access

Product updates

1 week free trial included

24/7 customer portal with free easy cancellation

$ 50 / mo

Features

Analyze up to 500 homes at a time

FREE deal calculator app

One click property analysis

Zillow integration

1 year unlimited access

Product updates

1 week free trial included

24/7 customer portal with free easy cancellation

Monthly billing

Deal Finding Service

Any Questions?

What is Cash on Cash return?

In real estate investing, the cash-on-cash return is the ratio of annual (before-tax) cash flow divided by the total amount of cash invested, expressed as a percentage. It is often used in real estate to measure the investing performance of a listing and understand return expected on the money invested

What is the Rent-to-Purchase ratio?

Rent-to-Purchase ratio is (estimated monthly rent ÷ listing price). The larger the ratio, the higher cash flow potential, because you can charge more rental income relative to the cost to purchase the property.

What properties and neighborhoods are supported?

CashOn can analyze Zillow map areas that contain properties with rent estimates. Properties without rent estimates are not included in the CashOn analysis and results.

Where does the data come from?

Data is analyzed from Zillow.com including but not limited to the listing price, zestimate, and rental estimate.

This is not financial advice. Do your own due diligence.

We can not analyze properties that are not on Zillow. We can only showcase the best deals the market has to offer. We do not guarantee that you will find a great deal. We provide a set of metrics and tools to help narrow your search as you sift through a sea of options. You must do you own due diligence and research to come up with your own data and estimates. The estimates are not financial advice. Do you own due diligence.

Still have questions?

Contact us below.