/ Blog Details

By Minh Nguyen

19 Aug 2024

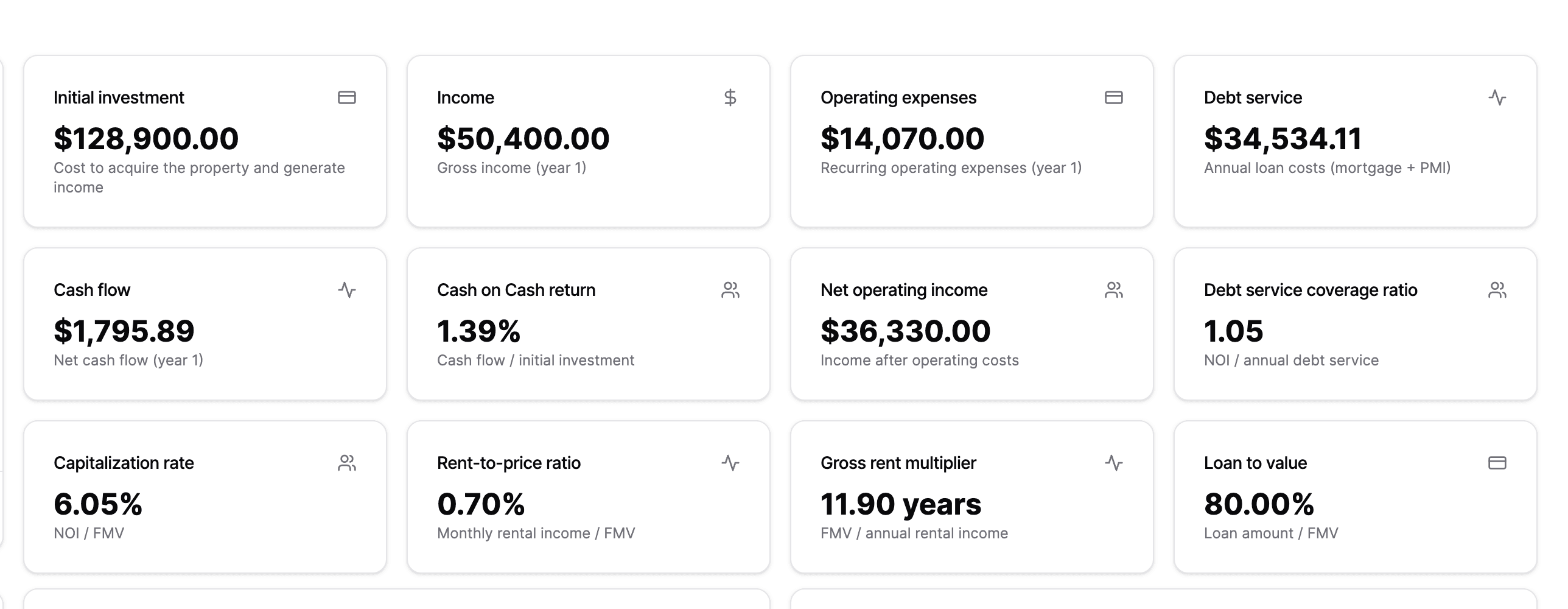

Are you confused by terms like cap rate, cash flow, cash on cash return, and NOI?

Are you ready to invest but worried you’ll make a mistake and lose your hard-earned money?

This guide will teach you important metrics professional investors use so you can decrease your risk and maximize your profits.

Bookmark our free real estate calculator and this guide to master these new metrics!

We have the best real estate analysis calculator and we're giving it to you for free!

Let’s get started!

What is it: The total money you need to buy your property and start making money (generally renting or selling). This includes your down payment, closing costs (fees when you buy it), and money you spend on repairs and improvements.

Formula: down payment + closing costs + renovations + etc…

Knowing this helps you to: Avoid losing money! If you don’t have enough money to cover the initial investment, you need to find someone who does (link to -> look into creative financing). If you can't find the money, you should NOT invest. Without the initial investment, you might run out of money, forced to abandon the project, and lose the money you put in. You should be conservative with your estimate because renovations always take more time and money than you expect. Make sure you have enough money to cross the finish line and get the property up for rent.

What is it: Your costs to run and maintain the property.

Here are the main types of expenses you need to know:

Knowing this helps you to: Avoid losing money! Knowing these expenses helps you understand the real cost of owning the property. Be honest, thorough, and cautious with your expenses to avoid surprises and losing money once you own the property. Expenses directly impact your profit, taxes, and property value.

Here's are the different types of expenses you may encounter on your investing journey.

| Expense | Capital Expenditure | Operating Expense | Fixed Cost | Variable Cost |

|---|---|---|---|---|

| Property management fees | No | Yes | Yes | No |

| Insurance premiums | No | Yes | Yes | No |

| Property taxes | No | Yes | Yes | No |

| HOA fees | No | Yes | Yes | No |

| Maintenance and repairs | No | Yes | No | Yes |

| Landscaping and lawn care | No | Yes | No | Yes |

| Utility bills (based on usage) | No | Yes | No | Yes |

| Tenant turnover costs (painting, cleaning, etc.) | No | Yes | No | Yes |

| Roof replacement | Yes | No | No | No |

| HVAC system installation | Yes | No | No | No |

| Major plumbing repairs or replacements | Yes | No | No | No |

| Kitchen remodeling | Yes | No | No | No |

| New flooring installation | Yes | No | No | No |

| Exterior painting | Yes | No | No | No |

| Mortgage payments | No | No | Yes | No |

| Debt service | No | No | Yes | No |

| Investor income taxes | No | No | Yes | No |

| Depreciation | No | No | Yes | No |

What is it: It’s the money you make from renting the property to tenants and from any businesses you run on the property.

Formula: rental income + business income + other income sources (like parking fees, laundry services, or storage rentals).

You care because: Avoid losing money and increase profits! Avoid losing money by making sure your income covers all the costs of running the property and any unexpected expenses, like fixing a roof.

Don’t forget to build multiple income streams to increase your profits! If you plan to sell the property, the amount of income it generates will affect how much buyers are willing to pay for it.

What is it: The money left over after you pay all the costs of running the property and your mortgage payments.

Formula: Income - operating expenses - mortgage payments (debt service)

You care because: Both to reduce risk and increase profits! Reduce your investing risk by investing in properties with positive cash flow. If you have more money coming in than going out, you have positive cash flow and a sustainable business. This extra money can be used for property improvements, other investments, or your next vacation! It's your money!

Lenders will look at your cash flow to see if you can repay loans. While cash flow is important, there are better metrics give a more complete investing picture.

What is it: The percentage of your initial investment that you get back in profits each year.

Formula:

You care because: This is one of the most important metrics to increase profits! This metric shows you how quickly you will earn back your investment from the money your property makes each year.

A higher Cash on Cash Return helps you compare different investment properties to find the one that makes the most profit. Cash on Cash Return is better than just looking at cash flow because it considers how much money you first put into the property.

Here’s an example with two investments:

| Property A | Property B | Buy 2x Property A | |

|---|---|---|---|

| Annual Cash Flow | $10,000 | $15,000 | $20,000 |

| Initial Investment | $100,000 | $200,000 | $200,000 |

| Cash On Cash Return | 10% | 7.5% | 10% |

While Property B has more cash flow, Property A has a better Cash on Cash Return.

If you take the initial investment of Property B and buy two of Property A, you would spend the same amount of money but make $5,000 more each year and get a 2.5% more Cash on Cash Return.

What is it: The total income from the property minus the cost to run it (operating expenses). The definition is in the name! Operating income only subtracts operating expenses!

Do not include expenses related to mortgage payments, big one-time expenses (capital expenditures), investor income taxes, depreciation (loss of value over time), and amortization (spreading out loan payments).

Formula: Income - Operating expenses

You care because: NOI shows how much money a property can make in a year without worrying about loan payments and big one-time expenses. When used with DSCR and Cap Rate below, you get a clear picture of the property's financial health.

What is it: A metric that shows if a property’s income can cover its debt payments, like mortgage payments.

Formula:

| DSCR | 1.2 |

|---|---|

| Net operating income | $120,000 |

| Annual debt service | $100,000 |

You care because: You want to avoid losing money! Lenders use this ratio to decide if they should give you a loan. The higher the DSCR, the better. A DSCR higher than 1 means the property makes more money than it needs to pay its debt. This gives you a safety net in case your income goes down and lowers the risk of not being able to pay the debt.

What is it: A measure of income performance on a property based on its net income and purchase price.

Formula:

You care because: Cap Rate helps you compare the income potential of different properties and their risks and rewards. There's a lot of debate on the definition and meaning of cap rate. Some believe it is a measurement of return on investment. Others argue that it can not show return on investment since it does not include your investment in the calculation. However one thing is true, it's one of the most powerful and popular terms in real estate investing.

Here's one way to interpret it.

| NOI | Market value | Cap rate | Risk & Return |

|---|---|---|---|

| high | low | high | A high Cap Rate means the property makes a lot of money compared to its price. This generally means higher risk but also higher potential for profit. Example: The property has strong income but has a lower purchase price because it needs repairs or is in a less desirable area. There could be an opportunity to increase its value by fixing it up. |

| low | high | low | A low Cap Rate means the property makes less money compared to its price. This generally means lower risk but also lower profit. Example: Good condition and in a better area so the property value is high. |

What is it: A quick way to see if a property might make money based on its purchase price and rental income.

Formula:

You care because: To increase profits when comparing between properties! Use it to quickly check if the property can bring in more money than it costs. Generally, if the purchase price is low and you can charge high rent, the property is more likely to make a profit.

The 1% rule says a ratio of 1% or higher is good starting point.

What is it: A simple way to estimate how long it will take for a property to pay for itself with rental income.

Formula:

You care because: You want to increase profits when comparing between properties! GRM helps you see how many years it will take for the property to make enough rental income to cover the purchase price. A lower GRM means you can recover your investment faster, which generally indicates a better deal.

For example, if a property costs $200,000 and generates $20,000 in annual rental income, the GRM is 10. This means it will take 10 years for the rental income to equal the purchase price.

| Purchase price | $100,000 |

|---|---|

| Annual rental income | $10,000 |

| GRM | 10 |

Keep in Mind: While GRM is a helpful quick comparison tool, it doesn't account for other important factors like operating expenses, vacancy rates, or potential property appreciation. Use it as a starting point, but make sure to consider other metrics for a complete picture of the investment.

What is it: A measure of how much your property’s value is covered by the loan.

For example: If you put down 20% down payment, then your loan covers 80% of your home's value so your LTV is 80%

| Loan to Value | 80% |

|---|---|

| down payment percent | 20% |

Formula:

You care because: It shows the risk level for lenders and affects loan terms. Lower LTV (below 80%) is better for getting good loan terms (ex. interest rates). High LTV indicates higher risk.

Enter your email to receive our latest newsletter.

Product updates and sales only

Master metrics like cap rate, cash flow, cash on cash return, and more with our free calculator and guide! 😍